- (888) 671-9568 Main

- info@usamerchantsolution.com

Can we offer Subscriptions with USA Merchant Solution?

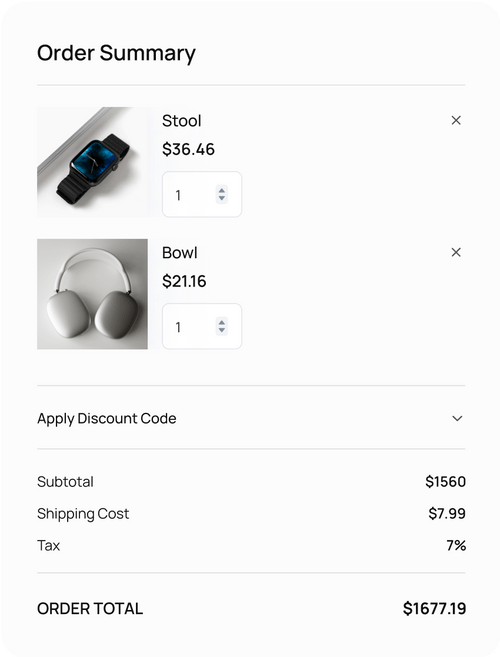

Saving you money on paper, ink, and boosting your green credentials in the process.

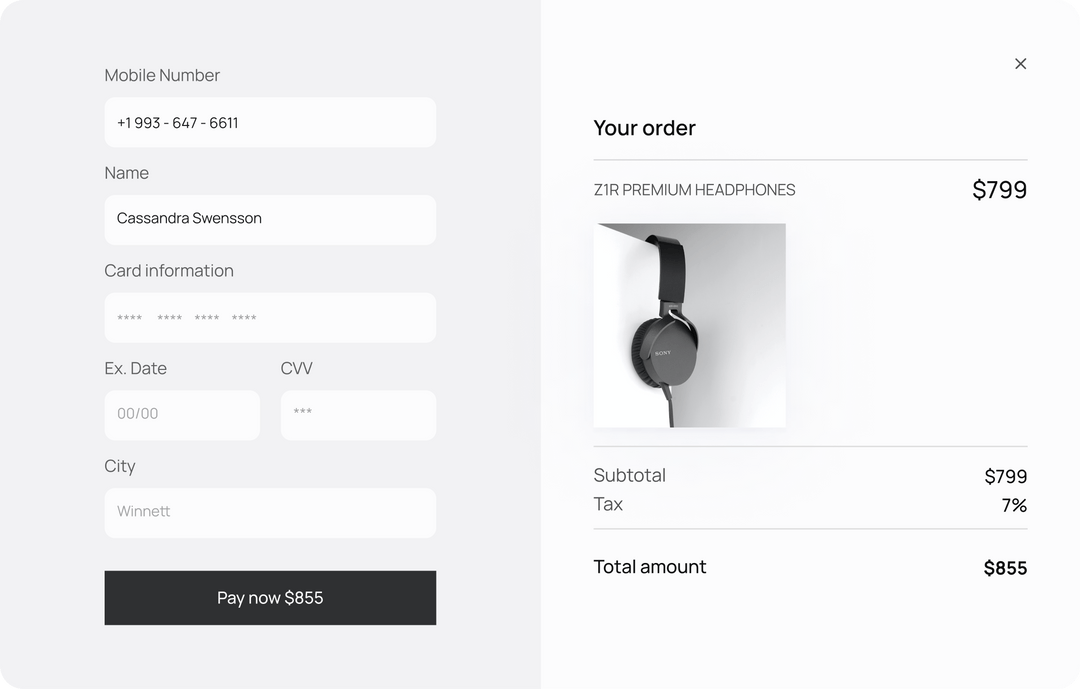

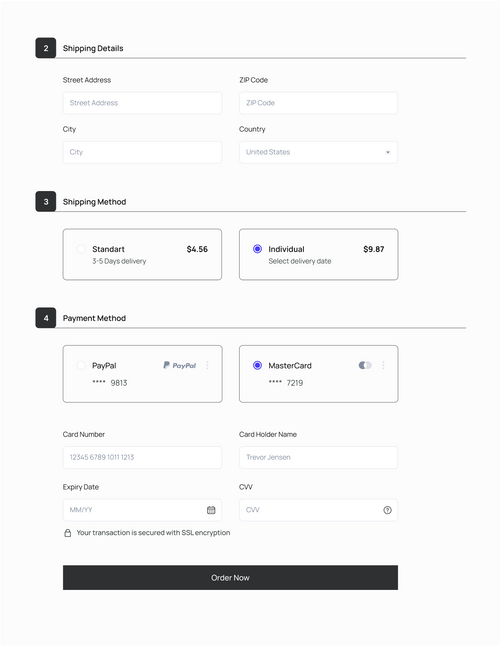

You can easily send electronic invoices and set up recurring payments.

Accepting on-line payments provides a better customer experience overall.